When War Shakes the World, What Stays Steady?

This morning’s news was all too familiar: new airstrikes, a wave of escalation, looming talk of war. Each headline leaves a pit in my stomach, not as a political analyst but as an everyday person—one who cares for family, for neighbors, for the peace of simple routines and the hope that our savings, retirement, and security are not just numbers on a page.

These moments make me reflect: when war shakes the world, what truly stays steady for ordinary American families? The answers aren’t always clear, but the questions grow more urgent with every global aftershock.

The Cost of War Beyond the Battlefield

We can’t ignore that war’s true toll isn’t confined to distant borders. Global conflict ricochets off battlefields and lands squarely in American households. Even if lives aren’t lost, wallets feel the bruises.

Inflation rises: As oil and supply chains are disrupted, the price of gas, food, and essentials usually spikes. Those increases filter into every bill and every trip to the store.

Retirement accounts tremble: Markets grow volatile on global uncertainty, causing 401(k) balances to shrink and IRAs to wobble.

Everyday planning falters: As the cost of living jumps, planned vacations, college savings, and even basic budgeting have to stretch further.

The ripple effect means our financial well-being is far more intertwined with world events than any single headline lets on.

We all know the cost of war — cities leveled, families shattered, lives lost. But here’s what’s not being said loud enough: war can wipe out your financial future, too.

The U.S. is on a dangerous path — record spending, endless global entanglements, and a national debt racing past $34 trillion. With interest payments alone nearing $1 trillion a year, Washington’s only “solution” is to print more money.

That means: more inflation, a weaker dollar, and your savings losing value by the day.

This isn’t fearmongering. It’s reality. And that’s why many Americans are turning to one of the few assets that holds value when everything else cracks: physical gold.

Goldman Sachs predicts gold could hit $4,500 by 2026. Central banks and billionaires aren’t waiting. Neither should you.

America’s Debt Trap

Layered on top of global conflict is America’s debt reality:

- $34 trillion in national debt.

- Over $1 trillion in annual interest payments—just to keep the books balanced.

What does our government do when squeezed? The “solution” has often been to print more money. But there’s a simple chain reaction:

- More dollars flood the system →

- Inflation rises (each dollar buys less) →

- The dollar weakens vs. global currencies →

- Our purchasing power erodes, often more quickly than paychecks or investment returns can keep up.

For households and retirees alike, this means each dollar saved loses value. Savings accounts become leaky buckets, and bonds pay less than inflation steals. For those on a fixed income, the pain is even sharper.

What Gets Hit First?

It’s natural to assume your money is “safe” if you avoid risk or just stick to conservative investments. But in a war-tilted, inflation-prone world, savings are exposed in new ways:

- Savings Accounts: Typically pay low interest that can’t keep pace with inflation. Each month, the value of what you can buy slips further out of reach.

- 401(k)s and IRAs: Markets tend to hate uncertainty. In 2022 and beyond, we’ve seen how global crises trigger sharp stock dips. Even “balanced” portfolios can fail to protect.

- Real-Life Example: Imagine a retiree who’s spent decades saving, only to watch prices for medication, groceries, and insurance climb faster than those investments grow.

It’s a bitter irony: playing it safe can cost you just as much as taking risks.

The Asset That Holds in Crises

So, what can truly hold steady?

Gold has a long, proven record as a store of value—especially in turbulent times. When markets stumble and currencies weaken, gold often strengthens:

- Goldman Sachs recently forecast gold as high as $4,500 an ounce, thanks to persistent global risk and a weaker dollar.

- Central banks are buying gold at record levels, quietly fortifying their reserves instead of relying solely on fiat money.

- Billionaires and institutional investors have taken note, quietly stockpiling gold and diversifying into tangible, non-paper assets.

It’s not hype—it’s a rational response to a world where uncertainty is the new normal. Gold doesn’t replace your emergency fund or diversify every risk, but history suggests it remains resilient where other assets falter.

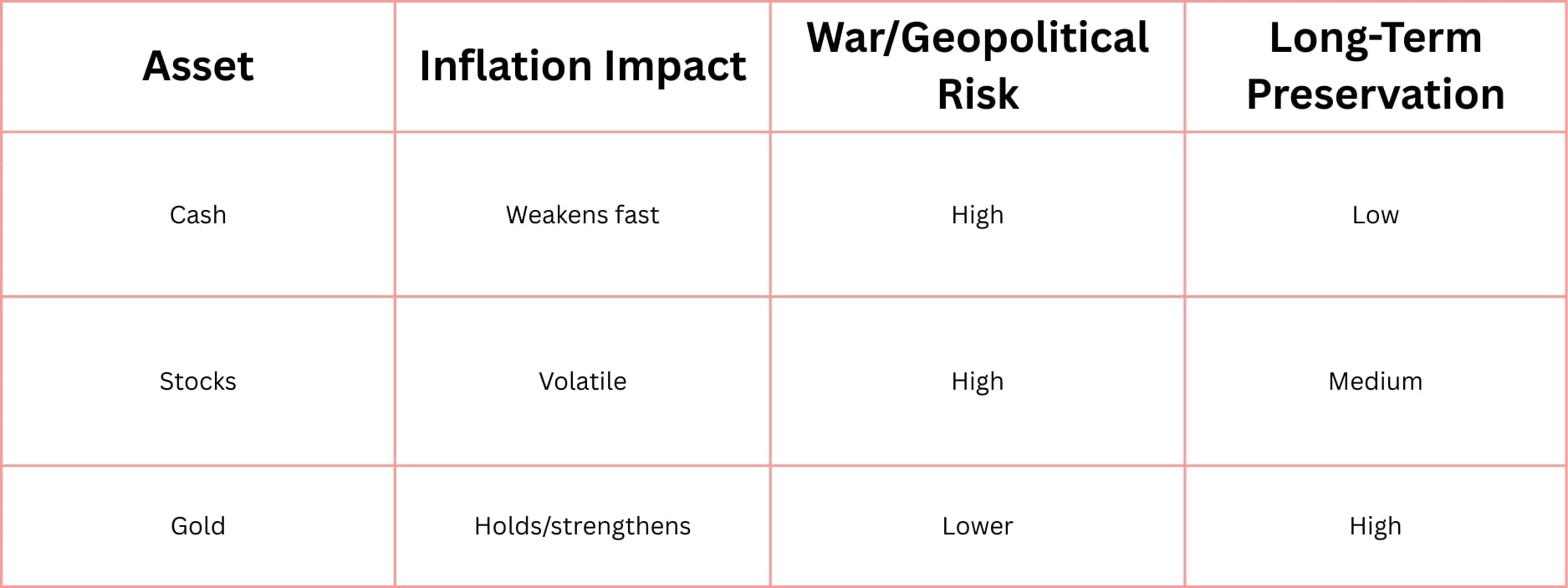

Cash vs. Stocks vs. Gold in Times of Crisis

This comparison isn’t about abandoning all else for gold—but about why serious investors (and nations) continue to hedge with hard assets.

Practical Steps

If headlines have you worried, here’s how to act, not panic:

- Audit your current savings and retirement exposure. List all accounts—bank, workplace retirement, brokerage—and note which are most at risk from inflation or market swings.

- Learn about IRS provisions that allow tax-free gold rollovers. Section 408(m) of the IRS code, for instance, permits qualified IRA rollovers into physical gold or silver, insulating you from some market and currency risk.

- Consider diversifying a small percentage of your portfolio into real assets. This could mean physical gold, silver, or other tangible stores of value. It doesn’t require a radical shift—often, 5-15% can act as your “insurance policy.”

- Plan for liquidity. Make sure you still have cash for emergencies but understand its limits in a crisis.

- Stay informed; stay grounded. Use trusted sources to track global trends. Resist knee-jerk moves—steadiness is a form of strength.

We can’t stop wars or Washington’s spending. We can’t predict every ripple from global news. But we can choose how to prepare.

When the world shakes, what matters is not what you fear, but what you hold—practically and psychologically. Having something real in your corner, whatever comes, may be one of the soundest financial decisions you make.

Steadiness isn’t just about money—it’s about peace of mind, about the ability to act wisely instead of react in panic. In uncertain times, that’s real power.

—

Claire West