Why Gold Moves First — And Gold Stocks Move Later

Late evening, laptop glow the only light in the room. I'm scrolling through charts the way some people scroll through photos—looking for patterns, anomalies, stories hidden in the data.

Gold has been pushing to new highs. $2,800. $3,200. $4,000. The headlines celebrate. Central banks accumulate. Investors who bought physical metal years ago watch their holdings appreciate with the quiet satisfaction of patience rewarded.

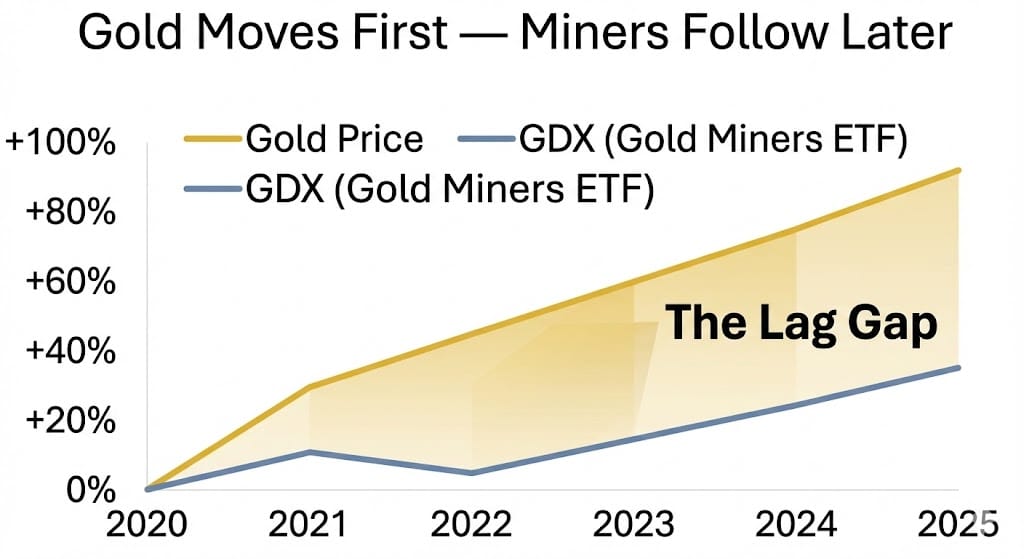

But when I pull up the mining stocks—the GDX , the majors, the juniors—the picture is different. Flat. Lagging. Disconnected. Gold surges 40% over the year. Miners barely budge by comparison.

It's a pattern I've seen before. The metal moves first. The stocks reprice later. And in that gap—that temporal dislocation between commodity and equity—lies an opportunity most investors miss because they're watching the wrong timeline.

The Myth Most Investors Believe

There's a common assumption in financial markets: gold prices and gold stocks move together. When gold rises, miners should rise. When gold falls, miners should fall. Simple correlation. Intuitive logic.

Except it's wrong.

The relationship between gold prices and gold equities is far more complex—and far more delayed—than textbooks suggest. According to World Gold Council data, gold mining equities have historically captured only 30-40% of gold price gains during bull markets, while experiencing 1.5-2x the downside during corrections.

The GDX—the benchmark ETF for gold miners—has underperformed physical gold by approximately 350% over the past two decades. Not because mining companies are poorly managed (though some are), but because the market prices miners on different criteria than it prices the metal itself.

Understanding this disconnect isn't just academic. It's the key to recognizing when mining stocks are undervalued relative to the commodity they produce.

The Lag Effect

Why do gold stocks lag? The answer lies in the mechanics of mining economics and market psychology.

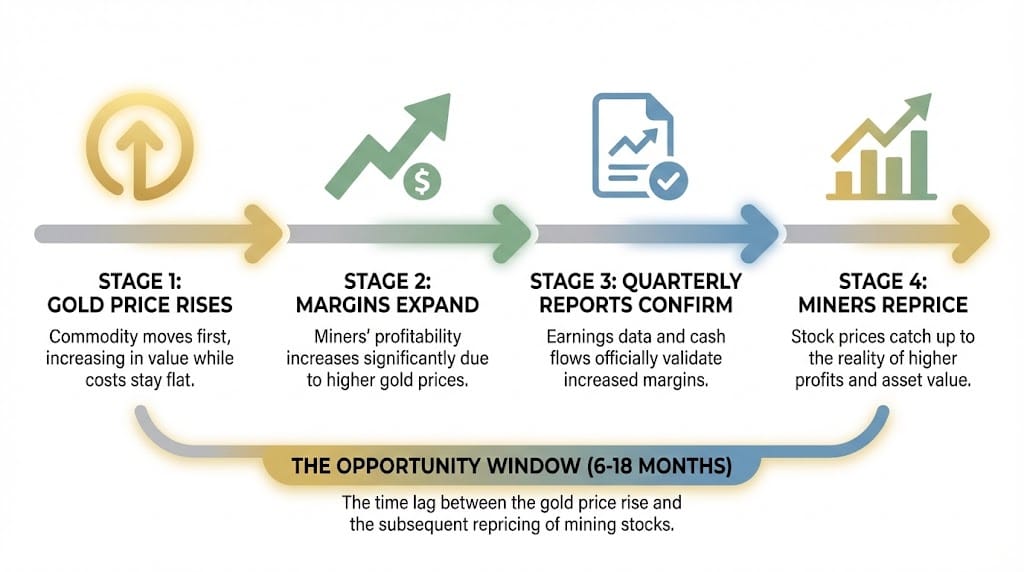

Production cycles: When gold prices spike, miners don't immediately capture those prices. Existing production is often hedged—sold forward at predetermined prices to reduce risk. It takes quarters, sometimes years, for higher spot prices to flow through to actual revenue.

Margin recognition: Analysts value mining companies on cash flow and earnings, not spot gold prices. If gold rises 30% but costs rise 15%, the margin expansion doesn't appear until quarterly reports confirm it. The market waits for proof.

Reserve revaluation: Higher gold prices make previously uneconomical deposits viable. But those deposits don't appear in valuations until geological assessments update. The value exists, but the recognition lags.

Sentiment delay: Retail investors follow headlines. Institutions follow fundamentals. And fundamentals—production data, cost reports, reserve updates—arrive on quarterly cycles, not daily prices. By the time the data confirms what the price suggested, months have passed.

In 2024, gold rose significantly while the VanEck Junior Gold Miners ETF tested multi-year lows relative to the metal. The ratio of miners to gold hit eight-year lows—a statistical anomaly that historically signals undervaluation.

Myth: Gold prices and gold stocks move in tandem.

Fact: Gold stocks almost always lag moves in gold’s price.

hat’s why despite a historic run in gold, I’m still predicting that my favorite gold stock will rise 400% in the coming months.

If you’ve been a gold stock investor, you’re well aware that even with big moves in gold, many gold stocks take their time playing catch up.

That’s just the nature of the business.

Higher gold prices take time to snake their way into concrete valuations that most investors understand.

Which means we have time to buy world class gold stocks NOW - before most investors catch on to the value.

If you’re looking for a no-brainer gold stock to own today, take a look at my free investment brief:

Why This Lag Creates Opportunity

Most investors see the lag as a problem. The informed see it as a window.

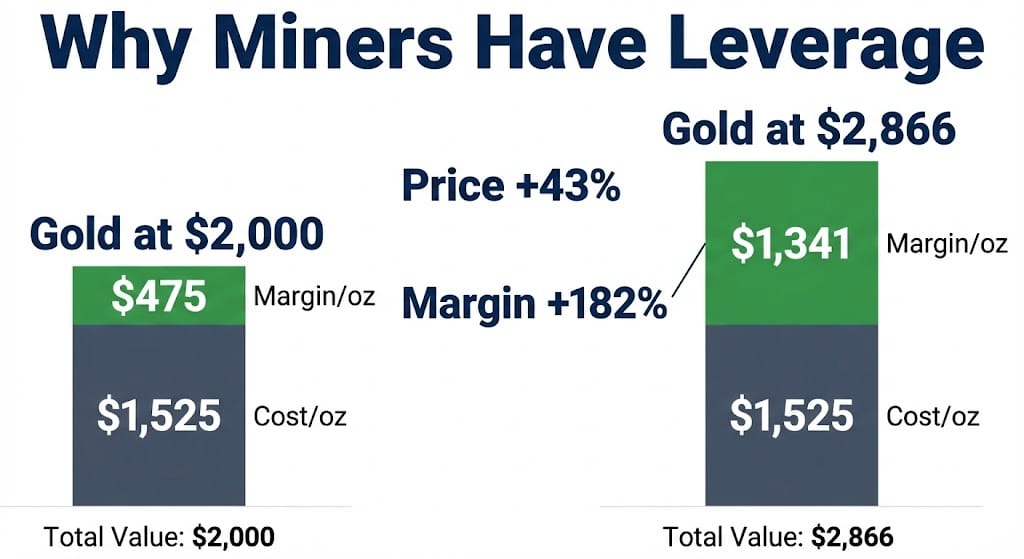

When gold rises and miners don't, the market is essentially offering a discount on future earnings. The metal has repriced. The stocks haven't. And because mining companies have operational leverage—fixed costs against variable revenue—every dollar increase in gold price translates to multiple dollars of margin expansion.

Consider the math: if all-in sustaining costs (AISC) average $1,525 per ounce and gold trades at $2,866, miners are generating $1,341 per ounce in profit. When gold was $2,000, that margin was $475. The price rose 43%. The margin rose 182%.

But share prices don't immediately reflect that margin expansion. They wait for earnings reports. They wait for production updates. They wait for analyst revisions.

That waiting period is the opportunity.

The 2025–2026 Setup

The current environment amplifies this pattern.

Gold prices have surged to record highs—driven by central bank accumulation (220 tonnes in Q3 2025 alone), geopolitical uncertainty, inflation hedging, and structural concerns about sovereign debt. Bank of America raised its 2026 forecast to $5,000 per ounce. JPMorgan projects $4,000 by mid-2026.

Yet mining equities remain compressed. Valuation multiples—price-to-book, price-to-cash-flow—sit at historic lows despite unprecedented profit margins. Schroders analysis suggests that if gold equities reflected current margins, they would need to nearly double relative to the gold price just to reach fair value.

The disconnect is structural, not accidental. Investors remain skeptical after years of cost overruns, capital misallocation, and disappointing acquisitions. But operational discipline has improved. Costs have stabilized. And companies approaching production milestones offer the clearest catalyst for repricing.

The Key Insight

Here's the pattern that matters: gold stocks don't follow the spike immediately. They respond when production and margins get locked into financials.

A miner trading at depressed valuations while gold sits at $4,000 is being priced for yesterday's doubts, not tomorrow's cash flow. When the next quarterly report shows margin expansion—when production comes online—when reserves are updated to reflect higher prices—the market reprices.

But by then, the easy gains are gone. The window closes. And those who waited for confirmation buy at prices that already reflect the obvious.

Our partner today highlights a world-class gold stock expected to begin production in January 2026—a milestone that could make its true value obvious to the broader market.

Own My #1 Gold Stock BEFORE the 5X Market Revaluation

Golden Portfolio

I've learned to distrust headlines. They tell you what happened, not what's happening. Gold hitting record highs is news. Miners lagging is a footnote. But the footnote is where the opportunity lives.

Timing in markets isn't about predicting tops or bottoms. It's about recognizing cycles—understanding that capital flows follow patterns, that recognition lags reality, and that patience in the gap between price and perception is where asymmetry compounds.

Gold moves first because it's simple—pure price discovery, no earnings reports, no production delays. Miners move later because they're complex—tied to operations, costs, and the quarterly rhythm of corporate disclosure.

That complexity creates friction. And friction, for those who understand it, creates opportunity.

The lag isn't a problem. It's a window.

Gold has already moved. Central banks have already accumulated. Macro instability has already driven capital toward hard assets. The question isn't whether the thesis is valid—it's whether miners will reprice to reflect it.

History suggests they will. The pattern is consistent. The catalyst is production. And the opportunity exists for those willing to position before the market confirms what the price already signaled.

I close my laptop. The charts fade. But the pattern remains—gold rising, miners lagging, and somewhere in that gap, the quiet arithmetic of time arbitrage working for those patient enough to see it.

—

Claire West