Why I Track Net Worth Quarterly — Not Monthly

The first time I resolved to “get serious” about my personal finances, I did what most well-meaning people do: I started tracking my net worth every month. It sounded responsible, even a little bit powerful—like I could will my way to financial mastery with a new spreadsheet and a monthly check-in.

But within a few months, I found myself emotionally tangled. My net worth would swing up (cue relief and pride), or down (cue anxiety and frustration), based not on any real changes I’d made, but on market zigs and credit card payment zags. I started dreading these check-ins. My mood followed the markets. The clarity I craved was lost in volatility’s noise.

That’s when I realized: clarity comes not from how often you check—but from how much distance you give yourself to actually see the bigger picture.

Why Monthly Feels Too Close

There’s a hidden peril in monthly net worth updates. Each cycle, I’d get frustrated—sometimes I’d feel “richer” just because payday fell before the 30th, or “poorer” because my 401(k) dipped. The numbers didn’t always reflect my habits or plans; sometimes, they just echoed random calendar quirks or market jitters.

- Market fluctuations: One red week in the S&P 500, and my investment balances “fell”—even if I didn’t sell a thing.

- Paycheck timing: Am I ahead, or did my paycheck just hit before the end of the month?

- Billing cycles and big payments: A late credit card payment or property tax bill made it look like I took a loss, even though nothing meaningful changed.

Soon, the whole exercise started to feel like chasing shadows. Obsessive tracking created a false sense of urgency—each blip felt like a report card, when in reality, most of it was just noise.

Quarterly = Long Enough to Show Trends

Then I tried something radical (at least for a former spreadsheet nerd): updating my net worth just once every 90 days. The change was immediate and profound.

Each quarter, the numbers told a story—not of every little bump, but of true trends:

- Signal, not static: Three months is long enough for a pattern to emerge—a chance to see if the choices I made actually built something.

- Noise fades: Individual paychecks, bill timings, or market dips stop dominating the narrative.

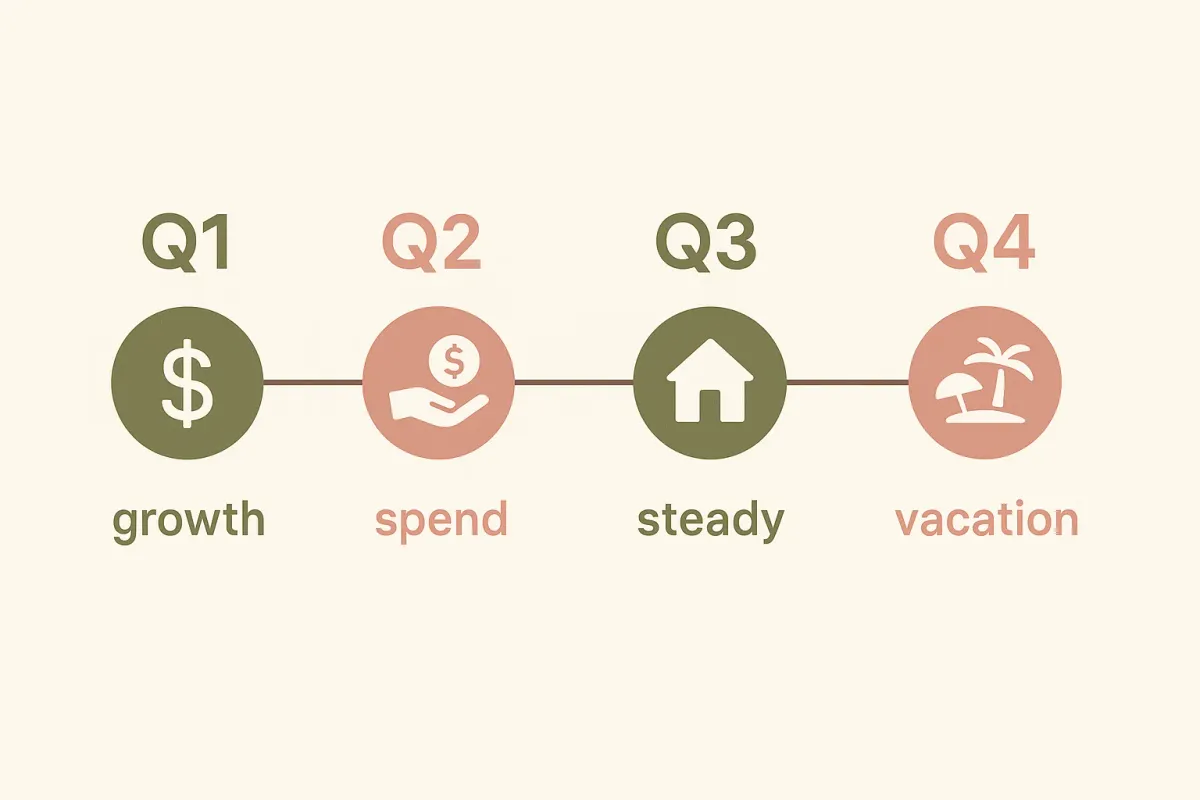

- Longer-term mindset: Quarterly intervals lined up with my investing habits and real life—reminding me that growth, like all good things, happens over seasons, not sprints.

Suddenly, my sense of financial health was driven by what I was doing, not what the market was doing to me.

How I Calculate My Net Worth

My process is intentionally simple—the more complicated, the less likely I’ll stick with it.

- Assets: All cash and checking accounts, savings, investments (brokerage and retirement).

- Liabilities: Every debt, from credit cards (even those I pay in full), student loans, to car loans.

- Net worth:

Net Worth = Total Assets − Total Liabilities.

I record everything in a single Google Sheet with clearly labeled columns for each calendar quarter. No syncing, no specialized apps—just a high-signal, low-drama statement of my current position.

Quarterly Reflection Prompts

At each quarterly review, I don’t just update the numbers—I ask myself three questions:

- What changed and why?

Was it markets, saving habits, a windfall, or an unexpected bill? - Am I closer to my goals or just busier?

Did progress happen because I was intentionally moving forward, or was it just background noise? - What was one smart financial move I made?

I document a single choice—large or small—that truly made a difference. Sometimes it’s upping my 401(k), sometimes it’s canceling an unused subscription.

Real Example: How One Quarter Rebalanced My View

Earlier this year, January was rough. My investments dropped, and an annual insurance bill hit. Monthly tracking would have left me discouraged—my net worth was lower than in December, and my instinct was to “fix” something.

But when I updated my sheet at the end of March, things had shifted. Markets recovered, the recurring big bill was balanced out by new paycheck deposits, and my overall trend was positive. The quarter showed steady growth—even a small boost to my emergency fund.

Without the perspective of a longer window, I’d have mistaken one dip for a disaster, rather than a natural part of the cycle.

When NOT to Track Net Worth

Quarterly tracking brings calm, but there are a few moments I intentionally don't update my numbers:

- During stressful or highly unstable seasons: If work or life feel unsettled, I give myself permission to skip a quarter. Clarity matters, but forcing it when stressed never serves me.

- Right after large, one-off purchases: Vacations, surgery, or moving expenses can spike liabilities and deplete savings. Before accounting for those, I wait a month or two for things to settle—so my view reflects a stable baseline, not the blur of unusual life events.

Bigger Picture = Bigger Calm

“Monthly noise keeps you busy. Quarterly trends show you who you’re becoming.”

If you’ve ever felt like your financial check-ins left you more unsettled than focused, consider zooming out. Let the little bumps recede; let your real choices and direction come into view. With bigger windows, you get bigger calm—and the clarity to keep building, one season at a time.

—

Claire West

P.S. If a quarterly check-in brings you peace (or new insight), I’d love to know. No affiliate links, no pressure—just sharing what’s helped me make sense of my numbers and my story.