Why I Treat My Savings Like My Stock Portfolio

The Problem With Dead Money

For most of my twenties and early thirties, I believed savings belonged in a metaphorical “vault”—quiet, untouched, the financial equivalent of a safety net under a tightrope. Each month I’d move a set amount from checking to savings, feeling responsible but not really thoughtful. But the year inflation shot up and interest rates stayed stubbornly low, I had an anxious realization:

My money was quietly shrinking as it “rested.”

A memory sticks with me: sitting in a coffee shop, checking my savings balance after months of careful deposits. The number looked comfortingly steady until I read a headline about rising prices. Suddenly, those “safe” dollars felt like they were melting, a slow leak behind the glass. I realized that, just like with stocks, doing nothing wasn’t always safe. Money parked in cash, earning less than inflation, can slowly lose its ability to move you forward.

Mindset Shift: Treating Savings as an Asset, Not Just a Safety Net

Most people treat their savings like a “break glass in case of emergency” tool—important to have, but rarely managed. But what if we saw cash like another asset class, with its own purpose, allocation, and review cycle? Not every dollar has to be perpetually at work, but every dollar should be thoughtfully staged for when and how it’s used.

Now, when I look at my savings, I ask three core questions:

- How much cash do I really need right now?

Enough for surprises, not so much it sits “dead” for months. - What’s the right balance between safety and growth?

Am I missing out on long-term gains by hoarding more than necessary? - Is my cash positioned for opportunity—or just for fear?

Too much conservative saving can breed inertia as easily as not enough.

By reframing savings as an active, managed asset, I sidestep both the paralysis of over-saving and the anxiety of being underprepared.

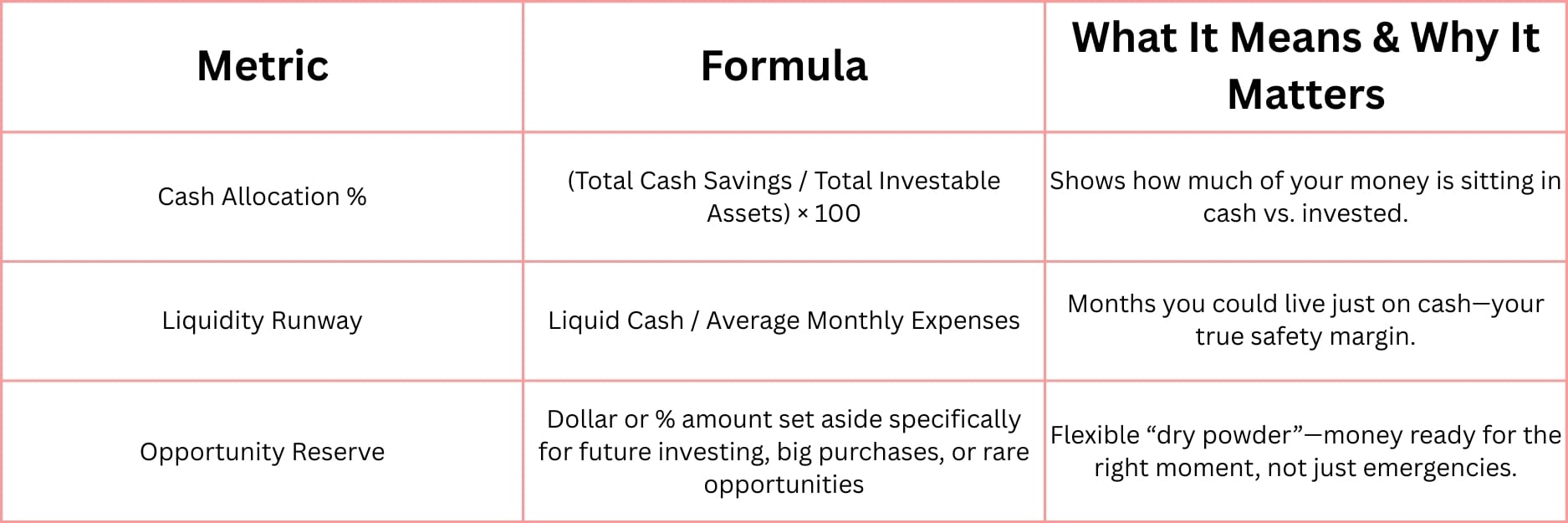

The Three Metrics I Track

Just like managing a portfolio, I use three metrics to keep savings aligned with my life—not too tight, not too slack. Here’s how I keep it practical and data-driven:

1. Cash Allocation %

I aim to keep my cash between 10–20% of my total investable assets—enough for safety and agility, but not so much that opportunity cost eats away at my net worth.

2. Liquidity Runway

My personal sweet spot is 3–6 months of core expenses in ready cash. Too little, and I lose sleep. Too much, and I know inflation is quietly at work.

3. Opportunity Reserve

This is a “fun” category: a bucket earmarked for seizing chances, whether it’s a market dip, a career course, or a once-in-a-decade trip. Rather than treating every dollar as “just in case,” I deliberately reserve a portion for “just in time.”

Investment Habit in Cash: Moving from Static to Strategic

When the three metrics are in check, I’m free to address excess cash as an opportunity.

Should I move more into the market, or let it ride?

Here’s how I choose—always calmly, never in a rush:

- If Cash Allocation % is high and Liquidity Runway is above target:

I’ll slowly transfer a portion from savings into my investment account, usually in broad index funds or ETFs. Sometimes it’s just a few hundred dollars at a time—tiny rebalances, not aggressive swings. - If a special opportunity comes up (the “Opportunity Reserve”):

I’m ready; I don’t have to pull out of long-term investments or second-guess myself. - If I dip below my minimum runway:

I pause investing and rebuild my savings first—security before growth.

It’s peaceful, not frantic. Rather than big, impulsive leaps, I think of it like tending a garden: pruning and feeding seasonally, never stripping the soil bare.

Some companies you only hear about after they IPO.

And some…

Eventual unicorns like Uber, Airbnb, and Facebook …

Forced the world to pay attention long before that.

Mode Mobile could be a new member to that second group.

Uber turned cars into taxis, Airbnb turned homes into hotels, and Mode Mobile is turning smartphones into EarnPhones.

With 32,481% hockey stick growth, A-list partners, and a product with more than 50M+ users, it’s what investors call a “category disrupter.”

The kind that could turn early capital into generational wealth.

They’re raising privately.

For now.

Investors can get $0.30 pre-IPO shares… but final allocations are disappearing quickly.

With a Nasdaq ticker ($MODE) secured, the company and their 50,000+ investors have eyes on potentially going public.

⚠️ The window to invest at $0.30/share is closing — act now.

Disclosures

Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

Please read the offering circular and related risks at invest.modemobile.com.

Why This Mindset Matters

Seeing savings as an intentional, managed part of your financial life does more than keep up with inflation—it leverages calm, not just caution. It dissolves the old myth of “dead money” and builds a safety net that flexes with you. Rather than waiting passively for emergencies, your savings become a source of readiness and possibility—a reservoir, not a moat.

I see my cash reserves the way I see my best stocks: as parts of an ecosystem, each with a unique role. Some dollars are for today, others for tomorrow. When they’re balanced, I feel empowered—never stuck, never reckless.

Takeaway: The Living Nature of Savings

Treating savings this way doesn’t mean you have to become a “finance person” or monitor accounts daily. It’s about a gentle discipline—monthly, quarterly—so that your cash is always a living part of your financial health.

Next time you look at your savings balance, ask: Is this money working for me, or just waiting?

Your money deserves to be as alive as your ambitions.

—

Claire West