Why Predictability Matters More Than Growth

I sometimes think back to two old friends of mine from my twenties. One was always chasing the next big thing: crypto during the early boom, meme stocks when they made headlines, the latest IPOs everybody swore would change everything. The other? She preferred the quieter path—steady dividend stocks, bonds, and savings accounts. She never sparkled at parties with tales of 10x gains. But she never looked stressed either.

Over the years, as I’ve watched both lives unfold, I’ve realized something: for most of us, predictability is a more precious gift than supercharged growth. Growth makes stories, but predictability builds lives.

We don’t always see it that way. In a culture that celebrates the jackpot outcome—viral fame, overnight wealth, “moonshots”—we overlook the quieter compounding power of stability. And yet, when I’ve sat at kitchen tables, whether in my own family or with readers who write to me, predictability is what most people truly crave: peace of mind, consistency, the freedom to plan tomorrow without fear.

That’s what I want to explore today.

Did you miss out on the 1000%+ gains of Bitcoin over the past five years? Here’s your solution!

Automatic Payment Pools can allow you to:

- Generate $1,000's/month in passive crypto income

- Earn consistently regardless of market fluctuations

- Start with as little as $50

Even better...

It works even if you’re clueless about crypto, because you're not profiting from any specific coin. Instead, you're pocketing a piece of every dollar transacted.

The Seduction of Growth

There’s something thrilling about the stories of explosive success. Bitcoin millionaires. Tech employees who bought stock early and retired young. Retail traders who turned a few thousand into six digits during the pandemic boom.

These stories capture us because they awaken hope. Hope that maybe luck, timing, and boldness could change everything for us too. The dopamine rush of watching an investment double in days is real. It feels alive, like being pulled onto a rollercoaster you didn’t even know you wanted to ride.

But I’ve sat with the other side of the story too. People who bought at the top because they didn’t want to be left out. People who thought they’d found their way to independence, only to watch 40% of their savings vanish in a bad month. Younger me included.

The hidden cost of growth-chasing isn’t just financial—it’s emotional. Volatility invites stress. Stress clouds decision-making. And once your well-being is shaken, it takes more than a portfolio rebound to rebuild it.

The Power of Predictability

Predictability tends not to make headlines. Nobody brags about their reliable monthly bond coupon. Amazon packages are more exciting than bank interest credit lines.

Yet in daily life, predictable flows do something more powerful than adrenaline: they build resilience.

When you know what’s coming in, you can map what’s going out. Bills, rent, daycare, retirement contributions—all of life’s messy but necessary budgets depend on some level of predictability. When consistency is in place, households can breathe.

It’s not glamorous, but it creates the foundation for everything else. After nearly two decades of writing about money, one truth keeps reappearing: those who prioritize predictability tend to sleep better, save steadier, and recover quicker when life throws curveballs.

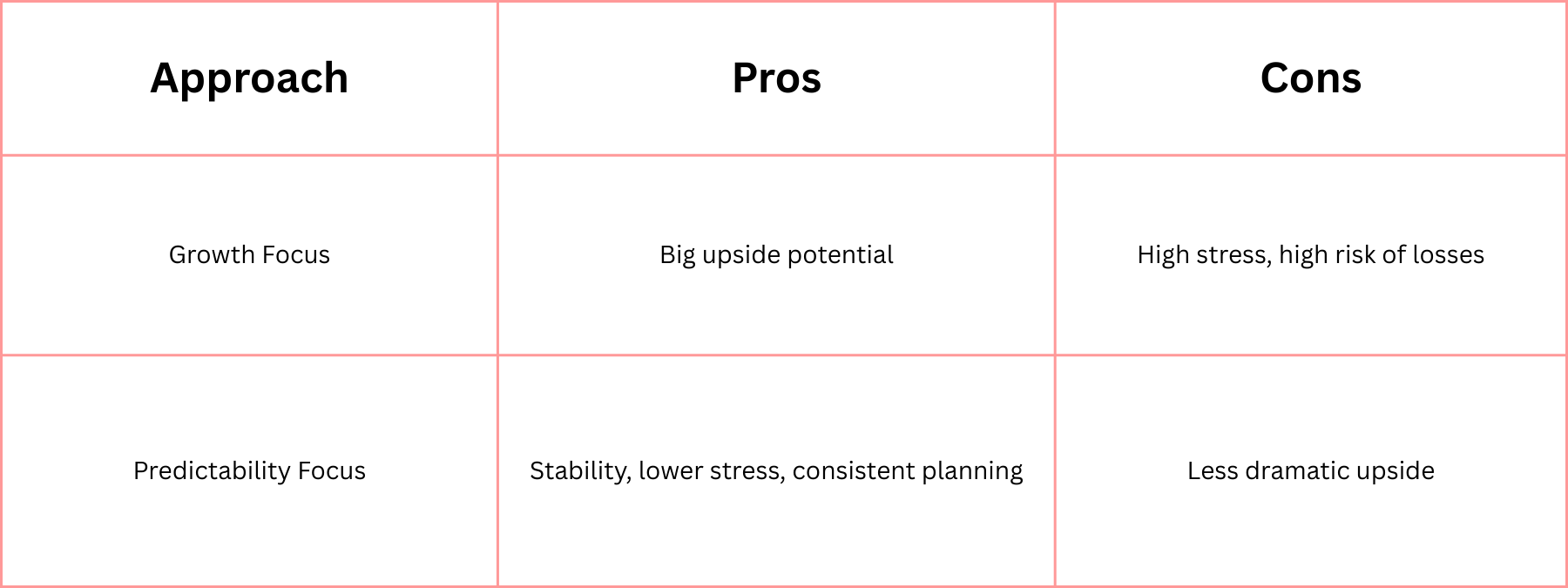

Here’s how I compare the two mindsets:

A Simple Formula for Peace

The trade-off between growth and predictability can feel complicated, but I like to use a framing that helps me:

Peace of Mind = (Predictability × Time) − Volatility

Put another way: the more predictable returns you can lock in, and the longer you hold them, the more resilient your household finances become. Volatility, on the other hand, chips away at that peace—even if the end returns look good on paper.

Think of it like sleep. One long, uninterrupted night leaves you energized. Three nights of short, jittery rest leave you exhausted, no matter how many hours you technically clock. Predictability in money works the same way—it compounds in quality as much as in quantity.

How I Choose Predictability Over Growth

Over time, I’ve put my own checklist in place. It’s not complicated, but it keeps me grounded when temptation calls:

- Diversify across at least 2–3 stable sources.

- Favor income tools with transparency.

- Avoid chasing “stories” without understanding risks.

- Reinvest small wins instead of spending them.

- Match risk tolerance to real-life timelines (retirement, college savings, mortgage payoff).

These steps don’t make me sound exciting at cocktail parties. But they’ve given me enough confidence to ride life’s ups and downs without second-guessing every financial move.

Risks & Reality Check

Predictable doesn’t mean perfect. There are risks hidden even in stability:

- Inflation steadily erodes the value of predictable payments. A 3% inflation rate over 20 years will eat almost half the purchasing power of fixed income.

- Stable-seeming platforms can fail or mismanage funds—think insurance companies, banks, or even pension funds.

- Psychological complacency is another silent risk. When income feels certain, people sometimes stop adjusting for future needs.

That’s why I don’t argue for predictability alone. Growth does matter. Over the long haul, it’s growth that helps us outrun inflation and build legacies. But the right balance—the one that shields your sleep while still nudging ahead of the rising cost of life—is different for everyone.

For my friend who once chased meme stocks, the shock of big losses eventually nudged him into a more balanced approach. For my other friend, predictability has always been enough—and she still manages gentle growth on the side.

After all these years, I don’t get swept up in the same thrill of high-growth stories anymore. Maybe that’s age. Maybe it’s experience. Or maybe it’s that life outside of our accounts matters more—with its birthdays, graduations, dinners at home, and all the memories we’d miss if we were glued to the stock ticker.

Growth stories capture our attention. They spark adrenaline, envy, curiosity. But it’s predictability that carries us across decades. Predictability that lets us say “yes” with confidence to tomorrow.

For me, the wins worth celebrating aren’t the loudest. They’re the ones that last.

—

Claire West