Why Simple Money Rules Quietly Beat Chaotic Markets

The realization rarely hits during a crash or a spike. It arrives in quieter moments.

A Tuesday evening, maybe. Bills spread out on the kitchen table. Markets green one day, red the next. You’re not blowing up your portfolio, you’re not day-trading meme stocks—you’re just trying to decide something simple: Do I move this money or leave it where it is?

And under that tiny question, there’s something larger: How much of my financial life is reacting to noise—and how much is guided by something stable, something I can trust?

That’s the quiet tension most people live with. Not “Will I get rich?” but “Can I rely on this?” In chaotic markets, it’s the difference between sleeping at night and refreshing charts at 2:00 a.m.

The Human Need for Predictable Income

People talk about returns. What they really crave is predictability.

Predictable paychecks. Predictable bills. Predictable timelines for when the mortgage is paid off and when retirement becomes more than a line item in a planner.

Stable systems feel like oxygen. You don’t think about them when they’re working. You only notice when they’re gone.

A paycheck that arrives on the same day each month.

A dividend that lands every quarter without fail.

A rental payment that hits your account on the first.

These aren’t just cash flows. They’re anchors in a world where news cycles swing from crisis to euphoria in 24 hours. When markets become chaotic, the value of something that behaves the same way, over and over, increases—not just financially, but emotionally.

And that’s why so many people, consciously or not, gravitate toward systems that feel regular, rule-based, almost mechanical. Not because they want to become robots, but because they’re tired of feeling like their money is strapped into a roller coaster they didn’t choose.

The Psychology of Codes, Signals, and Repeatable Patterns

There’s a reason people are drawn to the idea of “signals,” “setups,” and even “codes.”

On the surface, it sounds like marketing. Underneath, it taps into something deeper: the human desire for cause-and-effect clarity in a domain that often feels random.

In everyday life, we rely on unwritten codes all the time:

If you brush your teeth daily, your dentist appointments are easier.

If you exercise regularly, your energy improves.

If you sleep well, your decision-making sharpens.

These are not guarantees, but they feel code-like: repeatable input, broadly reliable output.

We want the same thing in finance: patterns we can trust. Not “this stock will double,” but “if I follow these rules, I avoid my worst impulses.” Not “code that predicts the future,” but frameworks that limit the damage when the future behaves badly.

That’s the heart of it: code-like certainty isn’t about being right—it's about knowing how you’ll behave, regardless of what markets do.

What we learned afterward: the crisis wasn't just the virus. It was the erosion of trust in systems people had relied on to tell them the truth. And once that trust breaks, it doesn't return quickly.

“Punch this 18-digit code into an ordinary brokerage account,” Larry told me.

At first, I was unsure…

But Larry Benedict managed one of the top 100 hedge funds in the world, so I paid attention.

“If my calculations are correct,” he continued, “this code could put over $6,000 in your account in seven days.”

According to Larry, one simple trade could have returned over $6,316 in cold hard cash.

And it took just seven days.

It was that fast.

So what exactly are these codes… and why are they potentially so profitable?

He’s just released a new free video explainer.

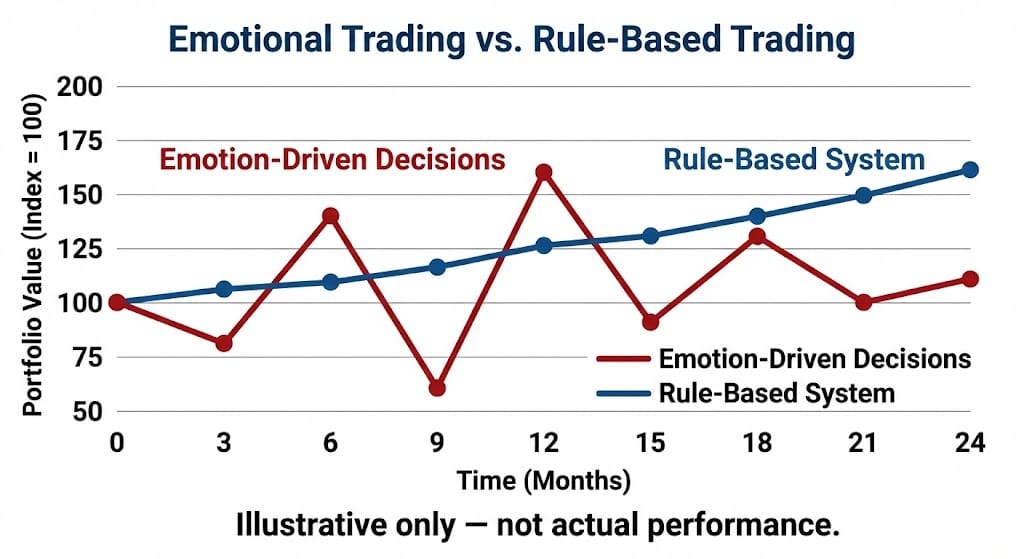

Mini-Case: How Pros Remove Emotion

The professionals who survive decades in markets rarely describe themselves as geniuses. They describe themselves as rule followers.

Many of them use systems that look boring on paper:

- Enter only when criteria A, B, and C align.

- Risk no more than 1% of capital on any single idea.

- Exit if price crosses level X—no questions, no “just one more day.”

Rules like this are designed to do something incredibly unglamorous: protect the trader from their own brain.

Behavioral finance has spent years documenting the biases that wreck portfolios—loss aversion, overconfidence, herd behavior, anchoring. Pros don’t avoid these biases because they’re more rational. They avoid them because they’ve built systems that limit how much damage their fear or excitement can do.

If you talk to veteran traders after a bad day, they rarely say, “The market hurt me.” They say, “I broke my rules,” or “The system did what it’s supposed to do—I just didn’t like the result.”

It’s not painless. But it’s predictable, and predictable pain is easier to live with than chaotic regret.

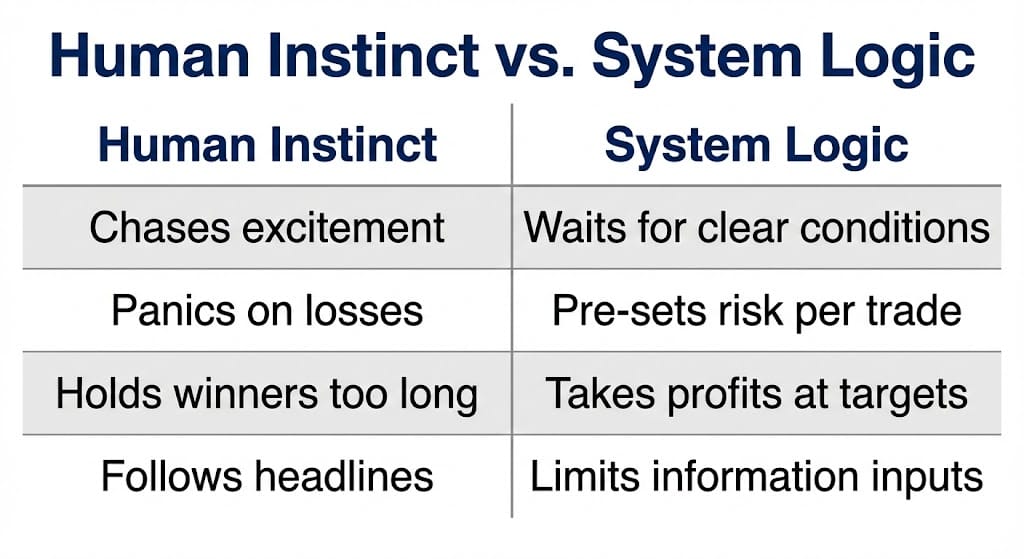

Human Instinct vs. System Logic

| Aspect | Human Instinct | System Logic |

|---|---|---|

| Entry decisions | “This looks exciting, everyone’s talking about it.” | “Only enter when predefined conditions are met.”vectorvest |

| Reaction to losses | “Double down or bail out now.” | “Risk size was set in advance; loss is contained.”collinseow |

| Reaction to gains | “Hold forever, it’s going to the moon.” | “Take partial profits at target levels, then reassess.” |

| Information intake | News, headlines, social media sentiment | Limited inputs, rules filter what actually matters |

| Emotional state | Swings between fear and euphoria | Discomfort still exists, but actions remain consistent |

| Long-term outcome | Highly variable, driven by impulses | More stable, driven by process rather than mood |

Systems don’t erase emotion. They contain it.

Why Some People Seek Frameworks, Not Forecasts

A forecast says, “This is what will happen.”

A framework says, “Here is how I’ll respond, no matter what happens.”

The more chaotic markets become, the less useful forecasts feel. People have been burned by precise predictions too many times—timelines that slipped, targets that never hit, narratives that dissolved under reality.

What they crave instead is a sense of: If X happens, I do Y. If Y doesn’t happen, I do nothing.

Frameworks are attractive precisely because they’re humble. They don’t claim to know the future. They claim to know the rulebook ahead of time.

Simple examples:

“If my savings rate drops below 15%, I pause new investments and fix cash flow first.”

“If a position falls 20% from entry, I exit, no exceptions.”

“If I haven’t read the financials or understood the business model, I don’t buy it.”

These are tiny rules with outsized impact. Not because they are magical, but because most damage in personal finance comes from a handful of very bad, very emotional decisions. Frameworks reduce the odds you make one.

The Emotional Relief of Rules That Reduce Chaos

There’s a particular calm that settles in once you’ve defined your rules.

Markets don’t become less volatile. News doesn’t become less dramatic. But your reaction becomes less negotiable.

You no longer ask, “Should I panic?” You ask, “Did my conditions change?”

You no longer ask, “Is this the top?” You ask, “Has my exit rule triggered?”

You no longer ask, “What does everyone else think?” You ask, “What does my plan say?”

Studies on systematic trading show that rule-based approaches can significantly reduce emotion-driven trade frequency and drawdowns, while improving overall portfolio stability. That’s the quiet benefit: not just better numbers, but less psychological noise.

In a world that constantly invites you into drama, having even part of your financial life governed by cold, boring rules is a relief.

The Soft Turn — Who You’re Really Protecting

When people talk to me about wanting “more certainty,” they’re rarely talking about their own ego. They’re talking about people.

A spouse who’s counting on shared retirement.

Kids who might need help with college or a first home.

A parent who may need support if their own savings run thin.

In that light, systems stop being about performance and start being about stewardship.

You build rules not to impress anyone, but to reduce the odds that a bad day, a bad headline, or a bad impulse derails the quiet commitments you’ve made to the people who rely on you.

That’s where “code-like certainty” finds its real purpose—not in pretending outcomes are guaranteed, but in making sure your behavior is not the wild card in the story.

A Resource for the Rule-Inclined

Some people feel this pull strongly. They don’t want hot tips. They want mechanics.

Hedge fund manager Larry Benedict built his reputation on rule-based trading systems. He now shares 18-digit “codes” tied to his strategy—signals his subscribers say have produced high-win-rate outcomes. More in his video.

Whether his specific approach resonates with you or not, the underlying idea is the same: structure over impulse, process over prediction.

Could a Strange Code Help You Legally “Skim” $6,361 Into Your Bank Account?

The Opportunistic Trader

There’s a temptation, when you first encounter rules or codes or systems, to treat them as escape hatches.

If the system is good enough, maybe you won’t have to think.

If the signals are accurate enough, maybe you won’t have to feel uncertainty.

If the framework is strong enough, maybe nothing bad will happen.

But that’s not how any of this works.

Markets will still surprise you. Life will still throw timing curveballs. No system is perfect. The value isn’t in eliminating uncertainty—it’s in knowing how you’ll respond when uncertainty shows up.

Small actions—defining a savings rule, setting risk limits, choosing when not to act—compound into outsized results over time because they prevent the worst mistakes, not because they unlock secret doors.

In the end, good systems don’t replace judgment. They protect it—from moods, from headlines, from the lure of doing something dramatic when the best move is often something very small, repeated quietly, over and over again.

That quiet repetition is where stability lives.

And in markets like these, stability is a more powerful form of wealth than most people realize.

—

Claire West