Why Undervaluation Happens in Plain Sight

Late evening. The kind of quiet that only comes when markets have closed and the day's narrative has settled into silence.

I'm looking at a spreadsheet—not a chart, not a trading dashboard, just a simple accounting of assets and liabilities. The numbers tell a story that the stock price doesn't seem to believe. A company owns something tangible, measurable, and conservatively valued. Yet the market trades it as if those assets barely matter.

This happens more often than most people realize. Not because markets are stupid, but because the story the market believes is always simpler—and louder—than the underlying math.

A stock goes down because of bad sentiment, so people sell without asking what the company actually owns. A sector falls out of favor, so entire industries trade at distressed valuations regardless of individual merit. A narrative hardens ("this is mature and slow-growing"), and nobody bothers to update it when conditions change.

In that gap between story and reality, undervaluation happens in plain sight.

Why Markets Misprice Value

Markets are not actually efficient at all times. This isn't a radical statement anymore—behavioral finance has spent decades documenting the ways human psychology distorts pricing.

Several biases work together to create undervaluation:

Narrative lag: A company's reputation is built over years. It changes over months. But the market's perception of it lags both. A company that was "bad" three years ago stays "bad" in the minds of investors long after it's become "good."

Recency bias: Recent price action overwhelms fundamental information. A stock that's fallen 50% feels like a failing business, even if the underlying assets are worth more than ever. The trajectory feels more real than the intrinsics.

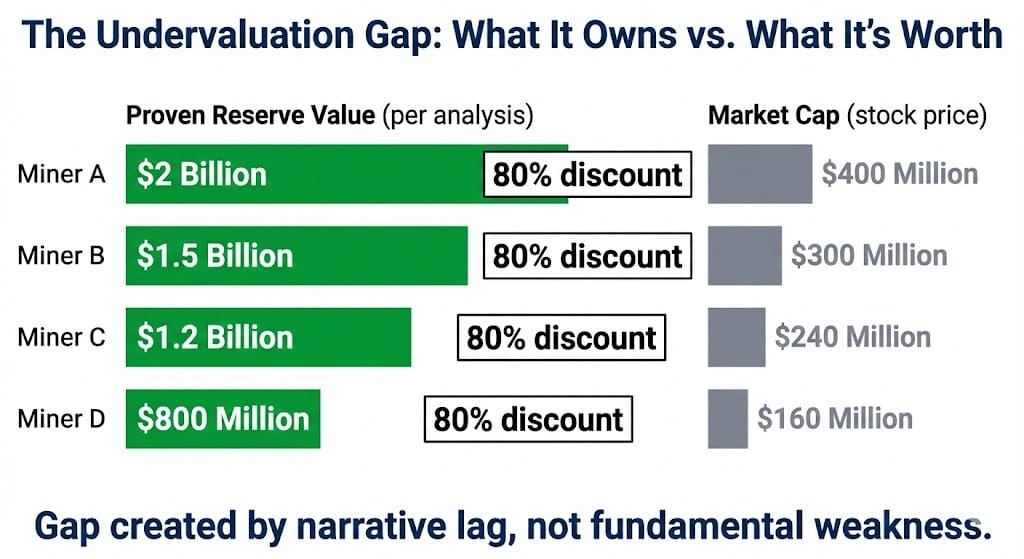

Complexity aversion: Investors prefer simple stories. "Tech will dominate" is simpler than "this miner has $2 billion in reserves but the market values it at $400 million." So they chase the narrative and ignore the math.

Emotional selling: Fear is immediate. Math is patient. When a stock falls, scared holders sell. Patient evaluators wait. The scared move first, setting the price.

The result: assets can trade at steep discounts to their underlying value for months or years—not because the value isn't real, but because the story doesn't match the assets.

Right now, my top four gold miners are selling at an average discount of 82%.

That’s not hype. It’s math.

Each one owns billions in proven gold reserves – billions the market isn’t pricing in yet.

That means you have an opportunity to buy a dollar of value for just .18 cents – and it won’t last.

Find out why it’s available… which gold stocks have true 100X upside potential… and how a tiny stake could hand you life-changing money…

Go here to get details on my top four picks for the coming bull mania

How is a situation like this even possible?

Because gold demand is headed much, much higher in the coming decade.

It’s not just central banks… hedge funds… or even retail gold buyers…

A new player is buying two metric tonnes a week – 58,322 Troy ounces… nearly $250 million… every single week. Why?

To bring gold investing to the masses in a way that hasn’t been possible for over 5,000 years.

Go here to read how I stumbled on the biggest gold story in over 50 years – and how a small stake in the right miners could make you rich

The Psychology of Hidden Reserves

A company's "reserves" are rarely as emotionally engaging as its latest product launch or CEO memo.

But reserves—whether oil in the ground, gold in a deposit, timber on land, or rare earth minerals in a mine—are real assets with real value. They don't require product-market fit. They don't depend on management charisma. They're just there, quantifiable, and increasingly valuable as the world competes for them.

Yet markets routinely underprice assets that are literally in the ground.

Why? Because they're not exciting. They don't trend on social media. They don't generate quarterly headline surprises. They just sit there, worth something, while the market pays attention to something shinier.

This is the hidden value psychology: assets that compound quietly are routinely discounted by a market addicted to dramatic narratives. The market will pay a premium for a company that might disrupt something, but it will underprice a company that definitely owns something.

Over time, this gap creates opportunity—but only for people patient enough to wait while the crowd chases stories.

Mini-Case: How Professionals Evaluate Real Value

Serious value investors approach assets from a different angle than the crowd.

Instead of asking "Will this go up?", they ask: "What is this actually worth?"

For a mining company, that means:

Proving reserves: How much ore is in the ground? How certain are those measurements?

Extraction cost: What does it cost to pull it out? That determines the margin at any given commodity price.

Discount rate: What's a reasonable haircut for execution risk, commodity volatility, and regulatory uncertainty?

Intrinsic value: Given those three factors, what should an investor rationally pay per ounce of proven reserve?

Then they compare that number to the market price. If the market price is much lower, they ask: "Why?" Is there a real reason (bad management, environmental liability, execution risk)? Or is it just narrative lag and fear?

The professionals aren't smarter than the crowd. They're just asking different questions. They're evaluating what's actually there, not what the story is about.

Market Narrative vs. Underlying Math

The contrast between these two frameworks shows up clearly:

| Market Narrative | Underlying Math |

|---|---|

| "Gold is risky, sentiment is weak" | "This deposit has 5M oz of proven reserves" |

| "Miners always disappoint" | "Cost per oz is $800; spot gold is $2,600" |

| "Old economy, not exciting" | "Every oz pulled generates ~$1,800 in margin" |

| "Too much leverage in the sector" | "This company has $1B in reserves, trades at $200M" |

| "Price action is falling; sell now" | "Underlying value compounding regardless of emotion" |

| "Wait for more clarity" | "Clarity exists in the financials; math is clear now" |

One framework is built on fear and narrative. The other is built on patience and arithmetic.

One changes weekly. The other compounds annually.

Why Deep-Value Opportunities Feel Uncomfortable

Here's the uncomfortable truth: real value often looks boring.

A company with $2 billion in proven reserves trading at a $400 million market cap isn't a thrilling story. It doesn't go viral. It doesn't have a charismatic founder. It doesn't disrupt anything. It's just... undervalued.

But that simplicity is exactly why it's overlooked. People distrust what they can verify too easily. They prefer stories that require belief in something future and uncertain.

Buying a stock because the math says it's cheap feels risky. Buying it because everyone's talking about AI transformation feels safer—even though it's statistically more dangerous.

This psychological mismatch creates persistent undervaluation.

And that mismatch is why value investing—actually looking at balance sheets and assets instead of narrative—remains one of the most reliable ways to build wealth over time, even though it never feels exciting while you're doing it.

What Readers Are Actually Protecting

When people ask about "opportunity," they're rarely asking how to get rich quick. What they're actually asking is:

"How do I protect my savings from being eaten by inflation?"

"How do I ensure my money is doing something useful, not just sitting there?"

"How do I sleep at night knowing my portfolio reflects reality, not hype?"

In that context, the appeal of deep value isn't excitement. It's peace of mind.

Peace of mind that your assets are backed by something real.

Peace of mind that you're not riding an emotional narrative that might reverse.

Peace of mind that compounding is happening quietly beneath the surface, regardless of what the headlines say.

For readers in their 40s, 50s, and beyond, that peace of mind is worth more than almost anything else.

A Framework for Understanding Value

Professional value investors have spent careers studying how to identify real undervaluation versus value traps (companies that look cheap because they're actually broken).

The difference comes down to asking better questions:

Is the asset real and quantifiable?

Is the discount explainable (narrative lag) or justified (genuine deterioration)?

Is management competent enough to execute extraction or operations?

Is the commodity/product in structural demand?

One analyst who's been studying undervalued gold miners for years recently identified four companies trading at steep discounts to the value of their proven reserves. Analyst Garrett Goggin says his top four gold miners trade at an average 82% discount to their proven reserves. He also points to a new market force buying two tonnes of gold per week, which he believes could fuel a major shift in gold demand. His report covers the thesis and top picks.

Whether or not his specific picks align with your strategy, the methodology is sound: measure what's real, compare to what the market is paying, and act when the gap is wide enough.

A secretive meeting in Colorado just laid the groundwork for gold’s return to the US Monetary system…

Golden Portfolio

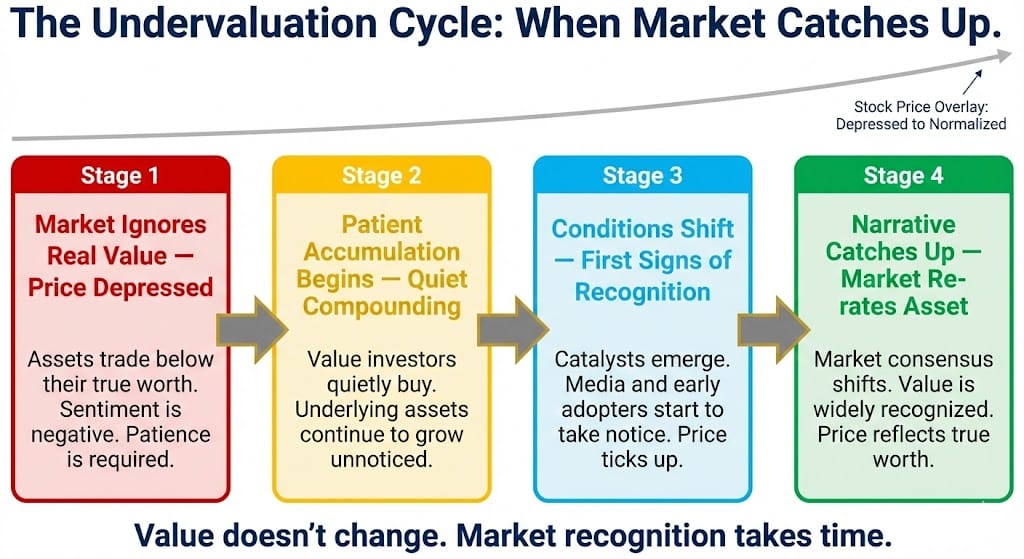

Undervaluation isn't exciting. It doesn't generate hot takes or social media virality. It's just quiet arithmetic—assets worth more than the market thinks, traded by people patient enough to wait for clarity.

The companies that compound slowly, backed by real reserves or real earnings, rarely make headlines while it's happening. You don't see them trending. You don't hear hot stock tips about them at dinner parties.

But they're exactly where wealth builds when people aren't paying attention.

The market will eventually recognize when something is undervalued. It always does. But "eventually" might be months or years away. In the meantime, patient investors accumulate quietly, protected by the same narrative lag and emotional selling that created the opportunity in the first place.

Value isn't about chasing extremes or betting on dramatic reversals. It's about understanding what's already real—the assets, the reserves, the earnings—and letting time do the compounding while the market slowly catches up to the math.

In a world obsessed with the next big disruption, there's a quiet strength in recognizing that sometimes the best opportunity is simply buying something real at a rational price and waiting.

The numbers don't lie. The market just doesn't always believe them yet.

—

Claire West