You’re Not in Debt. You’re in a Trap

There was a time when I carried a credit card balance that seemed manageable—at least at first glance. I paid the minimum every month, thinking I was doing the responsible thing. But every statement surprised me with a new total higher than before, and I didn’t realize how much interest had quietly piled up.

It felt like I was trapped in a slow leak, losing money without really seeing it. That’s when I understood a harsh truth: you’re not just in debt—you’re in a trap. The trap is the relentless, compounding credit card interest quietly eating away at your progress.

The Silent Drain of Interest

Most credit cards carry annual percentage rates (APRs) between 20% and 25%. Let’s say you have an average balance of around $7,300—the typical figure for many Americans carrying some debt. Here’s a simple formula to understand your monthly interest cost:

Plugging in the numbers:

That’s nearly $150 disappearing just to cover interest, before you even touch $7,300 of principal. And because credit card interest compounds—interest builds on interest—paying only minimums means your balance barely shrinks. Progress turns into stagnation.

Why Banks Love It

Credit card companies thrive in this silence. Most people glance at total minimum payments, not realizing how much of that goes straight to the bank’s “bonus pool”—the interest revenue that fuels their profits.

Each payment you make partially refunds the amount you borrowed, but the rest vanishes as interest income. As long as balances linger, banks win.

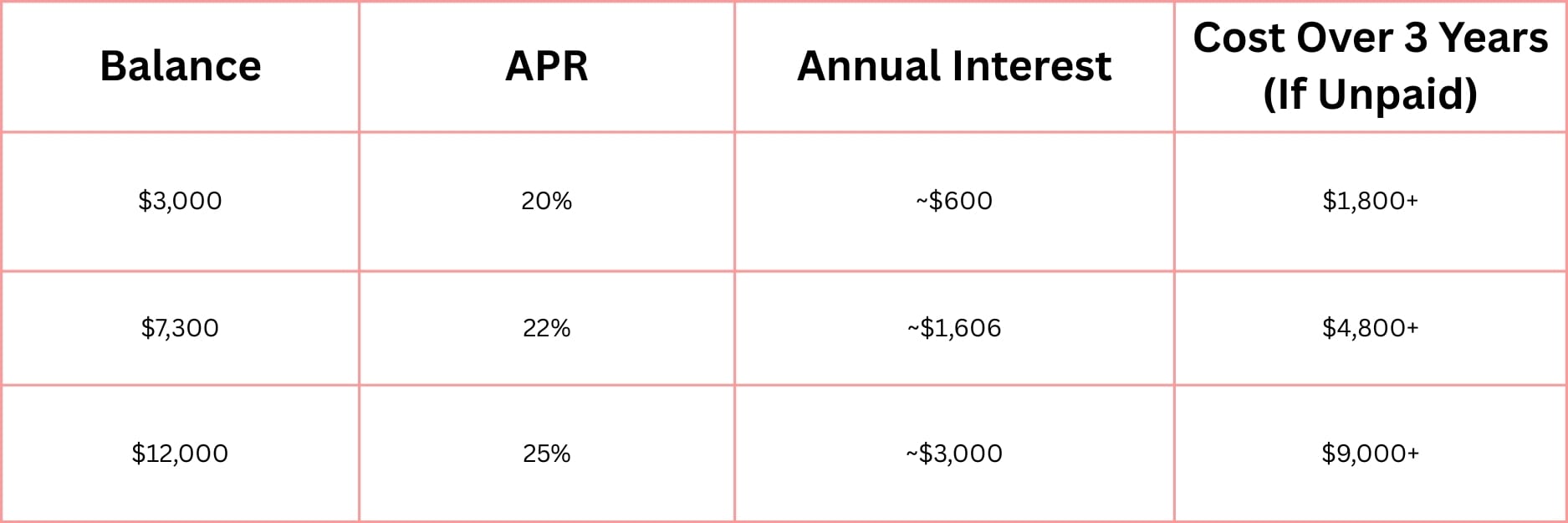

Mini Table: The Real Cost of Carrying Balance

This table captures the quiet financial storm your balance can weather if interest isn’t tackled—costs quickly ballooning beyond the original debt.

Paying 20%+ interest isn’t “debt management.” It’s a rigged game.

Banks profit while you sink.

But there’s a way out:

A 0% APR card for up to 21 months on balance transfers.

That’s nearly two years of interest-free breathing room.

The Way Out: Buying Breathing Room

Here’s where hope lies: 0% APR introductory offers on balance transfer credit cards. These offers allow you to transfer your high-interest credit card balance to a new card and enjoy up to 21 months interest-free on the transferred amount.

Think about that for a moment. Nearly two years where every payment you make hits the principal directly—making real progress possible rather than just feeding the interest machine.

Those months are breathing room. Time to get your debt under control without the extra burden of escalating interest.

Paying 20%+ interest isn’t “debt management.” It’s a rigged game. But there’s a way out: a 0% APR card for up to 21 months on balance transfers. That’s nearly two years of interest-free breathing room.

Steps to Escape Credit Card Interest: Your Checklist

- Calculate your true monthly interest. Know exactly how much you lose monthly.

- Stop adding new debt. Freeze new spending if you must; don’t dig a deeper hole.

- Consider a 0% APR transfer card—look for those offering 18–21 months promo periods.

- Set up automatic payments targeting principal—pay more than minimums and use your breathing room wisely.

- Mark the promo period’s end date visibly. Don’t let the clock run out unnoticed.

Debt is rarely just about numbers—it’s about stress, lost sleep, and opportunities missed. The good news? You can change the equation.

Buying yourself time doesn’t mean weakness or procrastination — it’s strategy, empowerment, and self-compassion. Every dollar not lost to sky-high interest is a dollar moving you closer to freedom.

When the weight of interest lifts, summer days can be sweeter—and even financial storms feel more manageable.

—

Claire West